Salary Sacrifice

What is Salary Sacrifice or Packaging?

This is an arrangement in which instead of receiving the whole remuneration package as Pay As You Go (PAYG) taxable income, the Employee elects to take part of their remuneration in some other form, typically the payment of regular expenses such as motor vehicle expenses.

In most cases, Employees pay less tax and Medicare levy under a salary packaging agreement. The types of benefits permitted and the potential value will vary depending on the individuals' normal PAYG tax rate and their type Employers' status under the legislation.

Employees of the Queensland Government are required to have their salary packaging arrangements managed by a contracted Salary Packaging Administrator.

All costs relating to the salary packaging arrangement are borne by the employee including management and administrative costs as part of their payroll deductions.

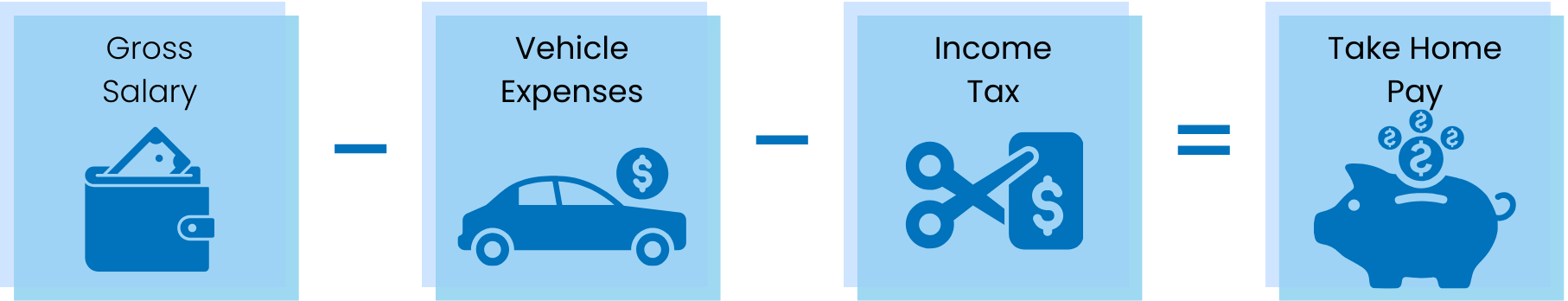

With Salary Sacrificing

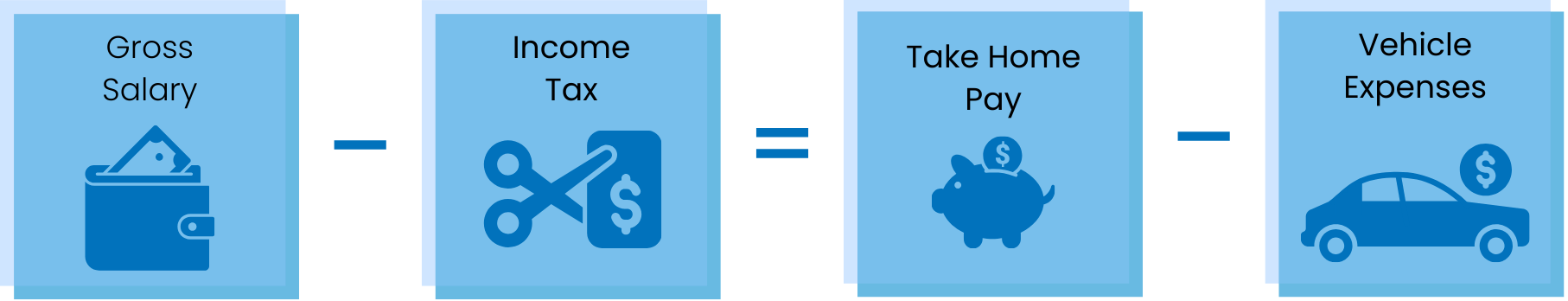

Without Salary Sacrificing

What is Statewide's role in your Salary Sacrifice arrangement?

Statewide Novated Leasing has been a novated lease supplier for Queensland Government Employees since 2016.

As per the Queensland Governments 'Arrangement for Salary Packaging' Novated Leasing Providers are to:

- Establish and maintain a novated lease for an employee, including providing quotes, as well as coordination and execution of the Queensland Government Standard Novation Agreement with the employee, employer and the financier,

- Process and settle the novated lease (including vehicle delivery),

- Arrange regular payments and reimbursement of novated leasing expenses.

For further information on salary packaging as a Queensland Government Employee, please see: